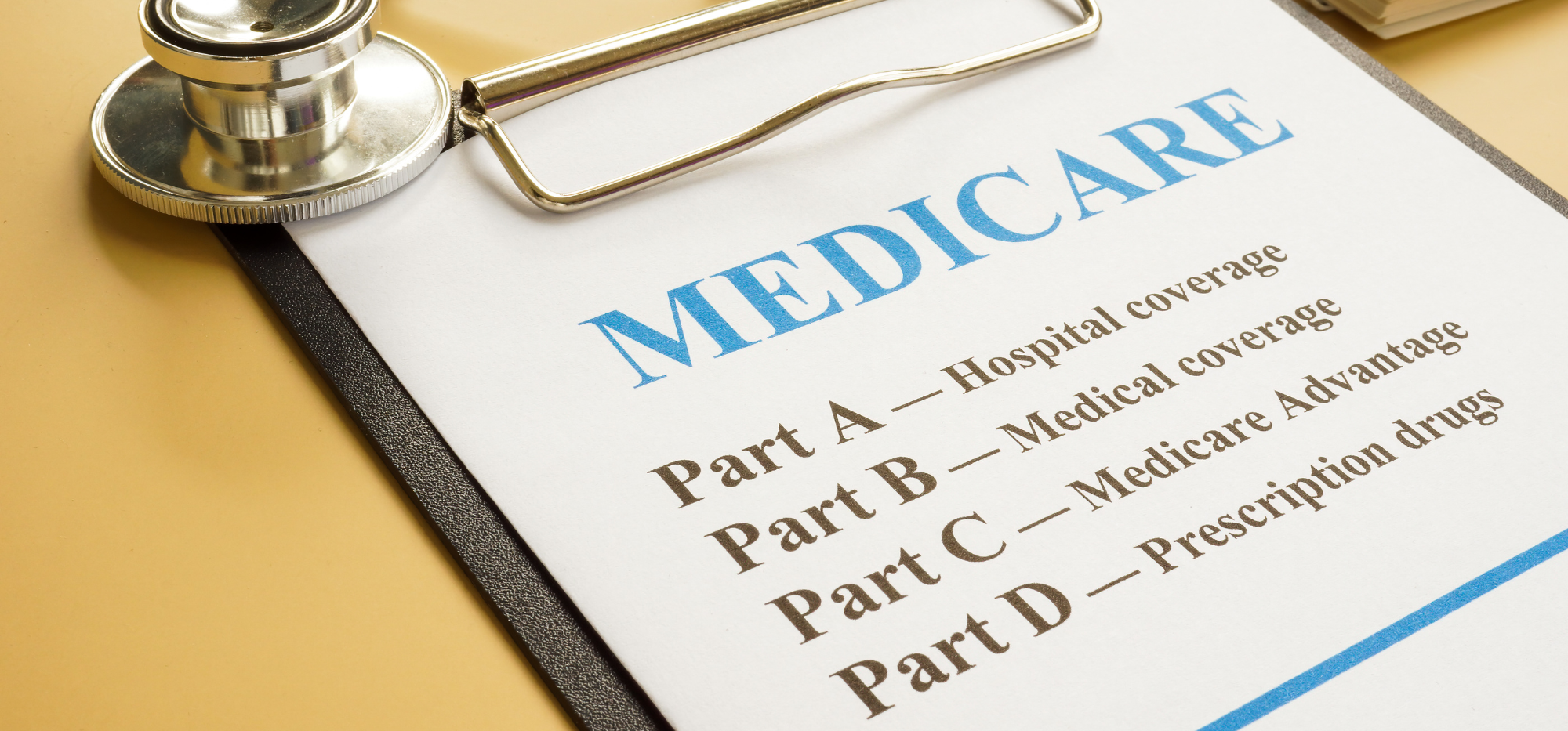

The Annual Enrollment Period (AEP) for Medicare Advantage (MA), Medicare Advantage Prescription Drug (MAPD), and standalone Prescription Drug Plans (PDP) is a critical time for advisors to analyze enrollment shifts and strategize accordingly. Understanding these trends helps advisors better position their recommendations to clients.

Key Enrollment Highlights from AEP 2025

Overall Medicare Advantage Growth: MA and MAPD plans saw significant enrollment growth during the 2025 AEP, continuing a multi-year upward trend. Advisors should note this growth reflects beneficiaries’ increasing preference for Medicare Advantage due to its additional benefits, lower upfront premiums, and integrated prescription drug coverage.

Leading Medicare Advantage Providers:

Shift in Standalone Part D Plans:

Regulatory and Market Changes for 2025

Strategic Recommendations for Advisors

The Medicare landscape continues to evolve, with the 2025 AEP showcasing strong Medicare Advantage growth and notable regulatory updates. Advisors who remain informed on these trends and effectively communicate the implications to their clients will be best positioned to offer value and trusted guidance.

Article Source:

Medicare Market Insights. (2024). AEP 2025: Part MA & MAPD Enrollment Growth by Plan. Centers for Medicare & Medicaid Services (CMS). (2024). Medicare Advantage and Part D Enrollment Data. U.S. Department of Health & Human Services. (2022). Inflation Reduction Act: Lowering Prescription Drug Costs for Americans.